sobre o que você deseja falar?

perguntas, sugestões ou problemas técnicos envolvendo a plataforma

informações sobre a empresa

GRI Dimension

General DisclosuresGRI Code

2-6Markets served by Suzano

Suzano is a global leader in the hardwood pulp market, with a strong presence in all its operating regions. Recently, our pulp has undergone a rebranding process and is now known as Suzano Biopulp. This change emphasizes its origin as a natural and renewable resource produced from eucalyptus. Suzano Biopulp is continually evolving to address global challenges sustainably and innovatively.

In 2024, the company's pulp sales totaled 10.7 million tons, serving 247 customers worldwide. Most of this volume went to producers of sanitary paper (62% of sales), followed by producers of printing and writing papers (15%), specialty papers (15%), and packaging (6%). As for the regional distribution of sales, 43% went to Asia, 31% to Europe, 18% to North America, and 8% to Latin America.

In the fluff pulp segment, we cater to markets that produce incontinence products, diapers for children, feminine pads, air-laid materials, medical pads, and pet mats. While other potential applications exist in sectors like construction and food, our primary focus is on the disposable sanitary napkin market. Our clients are mainly Brazil, China, Europe, Japan, Mexico, and the Middle East. We serve local and regional companies and global enterprises within the disposable sanitary napkin sector.

We have a diverse customer base in marketing our paper products, from notebooks and promotional material producers to producers of high-quality packaging and art books. As such, through these products, we serve markets in Brazil, South, Central, and North America, as well as other regions, on a smaller scale.

In the paperboard sector, we actively engage in key areas of the paper supply chain, including editorial, promotional, distribution, and conversion. Our primary focus is on the packaging market, encompassing products like cartridges, strapping, deliveries, envelopes, and more. We have expanded into the disposable cup market in recent years with our Bluecup product line. Suzano sells its products to printers, converters, and distributors, but we also strengthen our relationships with brand owners through collaboratively designed initiatives and projects. We emphasize that Suzano has no direct involvement in supplying inputs to the tobacco supply chain (converters or brand owners), maintaining its focus on segments that are aligned with the company’s values.

In the uncoated paper market, the company operates in key segments of the paper supply chain. This includes the publishing market, which encompasses educational materials, such as teaching systems and school books, and non-educational offerings, like books sold in major bookstores and online marketplaces. Additionally, the company produces notebooks, promotional materials, and packaging. Furthermore, Suzano serves as a paper distributor for customers who purchase smaller volumes, directly catering to the pulverized and micro-pulverized channels.

Uncoated products are also supplied to the single-use and packaging segments, specifically for retail bags, straws, and cardboard. Another key market in which Suzano operates is cut-size paper, which is part of our printing and writing paper portfolio. With a diverse range of brands, formats, and weights, we provide a strong and durable paper that leads to performance. This contributes to our customers' businesses inside and outside Brazil, mainly through the premium Report brand.

Our client portfolio includes corporate markets, stationery stores, self-service stores, copy shops, distributors, tenders, and end consumers. They can rely on our premium Report paper line and the Senninha children's line, perfect for coloring and cutting out.

We provide top-quality paper options for producing magazines, catalogs, promotional materials, editorial pieces, inserts, and art and photography books in the coated paper market. Our papers are made with the optimal blend of fiber and coating, ensuring superior printability and thickness. This allows us to deliver more robust, visually appealing, high-quality printed materials with vivid colors.

Suzano is the sole producer of coated paper in the country. It operates within the main segments of the paper chain: promotional, distribution, educational publishing, non-educational publishing, notebooks, and packaging. It primarily supplies the domestic and Latin American markets.

The company operates in the consumer goods market, emphasizing the tissue segment. This segment primarily includes paper towels, napkins, and sanitary papers, especially toilet paper. The North and Northeast regions are the most significant for this business unit, hosting four industrial facilities: Belém (PA), Imperatriz (MA), Maracanaú (CE), and Mucuri (BA), where Suzano has established a strong market presence. In 2021, the company inaugurated a new plant in Cachoeiro de Itapemirim (ES) better to serve the demand from markets in the Southeast, marking an expansion beyond its traditional focus on the North and Northeast regions.

Customer satisfaction

1. Pulp

In 2024, Suzano reinforced its commitment to customer satisfaction and experience by continuing the Pulp Customer Experience Journey program. The company achieved a 20 percent increase in the Net Promoter Score (NPS) compared to the previous measurement by implementing strategic improvement projects developed in collaboration with specialized consultancies. This improvement was based on feedback from over 110 customers interviewed.

This positive outcome highlights the success of our initiatives based on a thorough mapping of the customer journey. This process allowed us to identify critical areas and opportunities for enhancing our operations. In line with our dedication to continuous improvement, we refined our research methodology by broadening its global focus and improving our data collection tools. This refinement has led to a more accurate understanding of our customers' needs and expectations.

These actions strengthen our commitment to operational excellence and foster sustainable, long-term relationships with our customers, which are crucial for creating shared value and ensuring the sustainable development of our business.

2. Fluff

Eucafluff joined the Pulp CX Journey program, which aims to enhance the customer experience at all contact points with our company. As part of working groups, Eucafluff contributed to various projects aligned with the priorities set by the leadership of the Pulp Business Unit, of which Fluff is a part.

As a result of these project initiatives, we observed a significant increase in the Net Promoter Score (NPS) in the 2024 Annual Satisfaction Survey, which rose by 16 percentage points compared to 2023. In 2024, we interviewed 32 customers from various regions around the world. Along with the NPS, we evaluated customer satisfaction with our product, sales and customer support, and technical and logistical services. The insights gained from these results will guide us in developing new initiatives throughout 2025 to enhance value creation for our current and future customers.

3. Paper

A market company conducted the Paper and Packaging Unit's (UNPE) satisfaction surveys in 2024 by contacting customers via email and WhatsApp using internally validated questionnaires.

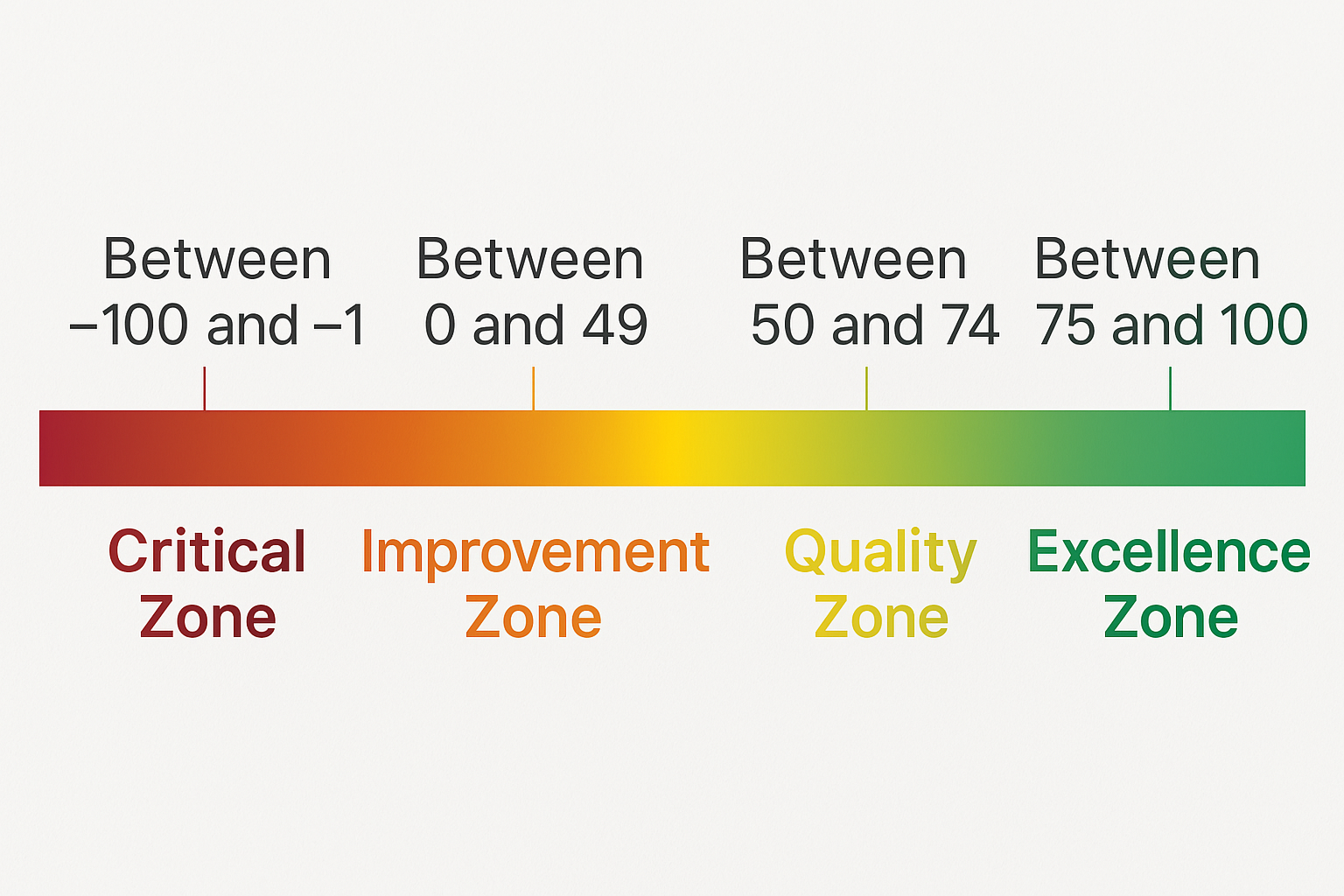

The questionnaires aim to understand customers' opinions on all the unit's areas and central processes. The results are evaluated using the NPS, Customer Satisfaction Score (CSAT), and Customer Effort Score (CES) metrics - with the main consequence being Suzano's classification concerning the pre-established NPS scales. This methodology aims to measure customer recommendation using a scale from -100 to +100, with the final score being classified into one of the following zones: Critical Zone, Improvement Zone, Quality Zone, and Excellence Zone, as shown in the image below.

In 2024, monthly surveys were conducted with active customers, meaning those who had made purchases the month before the survey was sent out. The results of the Net Promoter Score (NPS) surveys remained stable compared to 2023 for both the internal and external markets. The detailed results are not disclosed, as they are related to the strategic targets of the area.

Analyzing these results has allowed us to develop internal improvement projects to enhance the customer experience with UNPE. These improvements will impact all stages of the purchasing process, including interactions with the sales team, navigation of our e-commerce site, logistics and order delivery, payment methods, customer support, and more.

The outcomes from this year's working groups have been positive, as we have seen increased customer feedback and engagement within the company. We will closely monitor key performance indicators throughout 2025, focusing on continuous improvement projects. We aim to enhance service and care across our product lines and customer segments.

4. Consumer Goods

Research is carried out with consumers to develop new brands and products. The results are confidential.