sobre o que você deseja falar?

perguntas, sugestões ou problemas técnicos envolvendo a plataforma

informações sobre a empresa

Markets Supplied by Suzano

Suzano's pulp is sold worldwide, mainly to paper producers in the segments of Sanitary Papers, Printing & Writing, Specialty Papers and Packaging. In 2022, sales to the Sanitary Paper segment represented 63%, followed by Printing & Writing papers (16%), Specialty papers (14%) and Others (7%). As for the regions, 44% of sales go to Asia, 31% to Europe, 17% to North America, and 8% to Latin America.

In the same year, Suzano's sales volume reached 10.6 million tonnes of pulp, 0.13% more than the volume of 10.58 million reached in 2021. Pulp sales outside Latin America represented about 92%, with customers located in all regions of the world.

In the fluff pulp segment, we supply the markets for incontinence products, children's diapers, feminine pads, airlaid, and pet mats. There are other possible applications, such as civil construction and the food sector, but our prospecting focus is on the disposable sanitary pads sector. Our customers are mainly located in Brazil, Mexico, China, Japan, Europe, and the Middle East. We currently serve both local/regional companies and global companies, all of which are in the disposable sanitary pads sector.

In marketing our paper products, we have a very diverse customer base: from notebook and advertising material producers, to high quality packaging and art book producers. As such, we supply markets in Brazil, South, Central and North America, as well as other regions on a smaller scale with these products.

Concerning paperboard, we remain active in the main segments of the paper chain (editorial, promotional, distribution, converting), with emphasis on the packaging market (cartridges, belts, delivery, envelopes, among others), while in recent years we have also entered the disposable cup market with the Bluecup family of products. Suzano's sales are made to print shops, converters and distributors, but our relationship with Brand Owners is further strengthened through jointly designed actions and projects.

For the uncoated paper market, we operate in the main segments of the paper chain, including the publishing market - both educational in teaching systems and school books, and non-educational, such as the sale of books on the main marketplaces (physical and on-line), notebooks, promotional and packaging. Suzano is likewise active as a paper distributor for customers with lower purchase volumes, directly servicing the pulverized and micropulverized channels.

The sale of uncoated products also occurs for the single use and packaging segments in specific products for retail bags, straws and cardboard. A further strong market in which Suzano operates is that of Cutsize papers, which make up the portfolio of printing and writing papers. With an extensive portfolio of brands and different formats and grammages, we offer a strong and resistant paper, a leader in performance that contributes to the business of our customers both within and outside of Brazil, mainly through the premium brand Report. Within our customer portfolio, we have corporate markets, stationery stores, auto service, copy shops, distributors, bidding, as well as end consumers, who can rely, in addition to our Premium Report paper line, on our Senninha children's line, ideal for coloring and clipping.

As for the Coated Papers market, we offer the best paper options for the production of magazines, catalogs, promotional and editorial pieces, inserts, photography art books. Our papers are produced with the ideal proportion of fiber and coating, ensuring better printability and body. As a result, we are able to deliver printed material with greater robustness, better appearance and quality, and more vivid colors. We are the only coated paper producer in the country and we operate in the main segments of the paper chain (promotional, distribution, converting, packaging and sprayed) predominantly supplying the domestic and Latin American markets.

Customer Satisfaction

Pulp

The satisfaction survey applied in 2021 was the second since the merger of Suzano and Fibria, which occurred in early 2019. The main goal is to measure the satisfaction of pulp business clients in their relationship with Suzano. We heard from 45 customers representing about 70.8% of 2021 sales volume. Initially, customers assessed Suzano’s reputation, and then they evaluated their actual satisfaction. Beyond NPS (Net Promoter Score), the Survey took into consideration the business relationship pillars, back office, logistics, and technical service. The survey was applied by a private specialized institute on a confidential basis. Overall, the evaluations were positive: 76% of customers are very or completely satisfied, with praise for the good relationship, quality, communication, respect, and long-term partnership.

As in previous years, the 2022 Satisfaction Survey was conducted between November and December, aiming primarily to measure the satisfaction of pulp business unit (UNC in Portuguese acronym) customers and assess their relationship with Suzano. Thirty-nine customers were surveyed, accounting for approximately 62% of the sales volume in 2022. The Survey is conducted in two stages: an initial evaluation of Suzano's reputation, and a subsequent evaluation of customer Satisfaction. Along with the Net Promoter Score (NPS), the Survey assesses our customers' relationship with competitors, overall satisfaction, as well as their satisfaction regarding four relationship pillars, which are: logistics, back-office services, commercial relations, and technical assistance.

The Survey is carried out by an outsourced company specialized in data security and confidentiality. Overall, the feedback was positive: 74% of customers are completely or very satisfied. Moreover, the average NPS score increased by 0.4, pointing to an increase for the second year in a row. Among key aspects cited by the satisfaction results are good business relationship, fast and quality service, long-term partnership, sustainability, and communication.

Fluff

Eucafluff has been increasingly making its mark and establishing itself as a notorious company in the fluff market worldwide. As a result, it is crucial that we start monitoring customer satisfaction levels regarding both fluff supply service and product quality. Such understanding will be instrumental in enabling us to pinpoint improvement areas as well as opportunities within future operations.

Since 2020, we have been conducting an Annual Satisfaction Survey among customers around the world, assessing issues such as commercial services, logistics, product performance characteristics, among others. A key indicator being monitored is the overall satisfaction concerning the service/product supplied by Suzano - given that this data provides us with a snapshot of how the company fares in the eyes of its current clients. In 2021, the Survey indicated a stable evaluation of our clients globally, albeit one position higher in the NPS ranking, up from 3rd to 2nd position among the 11 competitor companies assessed. An improvement in customer evaluation in foreign markets was also registered, with a 4.5% growth in our average NPS score. Such progress is the result of improvements in the evaluation of the services provided (back-office, technical support, and logistics).

Paper

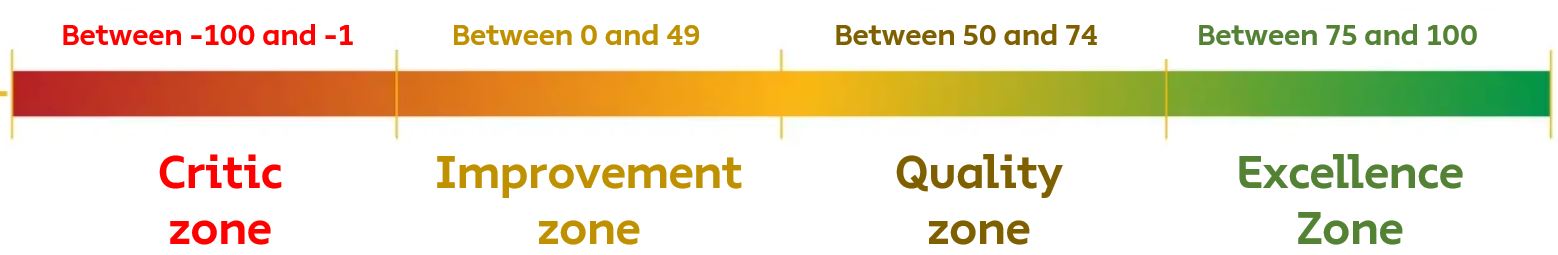

The Satisfaction Survey of the Paper and Packaging Business Unit (UNPE in Portuguese acronym) was conducted in 2022 by a market company, by contacting customers via telephone and/or e-mail, through an internally formulated questionnaire. The questionnaire aims to grasp the customers' views concerning all areas and main UNPE procedures. Results are measured based on the NPS and Customer Satisfaction Score (CSAT) metrics. The most significant result is Suzano's classification according to pre-established NPS scales, which is a methodology designed to measure customer recommendation using a scale of -100 to +100, with results classified into one of the following zones: Critical Zone, Improvement Zone, Quality Zone and Zone of Excellence, as demonstrated in the picture below.

In 2022, the Survey was conducted monthly with active customers, i.e. those who made purchases in the month prior to sending the questionnaire. Results showed an increase in the NPS indicator for the domestic market and maintenance of the index in the foreign market, along with the addition of new customer segments, such as small consumers. The results are not disclosed due to their link to the UNPE's strategic goals.

Analysis of the findings enabled us to implement internal improvement projects aimed at improving the customer experience with UNPE. Such improvements are extended to all stages of the purchasing process: from contact with the sales team, navigation in our e-commerce, logistics and order delivery, payment methods, customer support, and more.

Accordingly, one can see how the initiatives stemming from the working groups throughout the year proved positive, most of all in the domestic market and due to the inclusion of new audiences, extending both feedback received and the customer's voice in the company. We will closely monitor the indicators throughout 2023, paying special attention to projects defined at the end of the year, seeking to improve service and attendance levels in our product lines and in the most diverse customer segments.

Consumer Goods

There are surveys done with consumers concerning the development of new brands and products. The findings of both surveys are confidential.